The Exploitative Reality of Paying Taxes as Undocumented Immigrants

Taxation Without Representation: The price we pay is far steeper than just the dollar amount of owed taxes

Note: This story is shared by a contributor that wishes to remain anonymous.

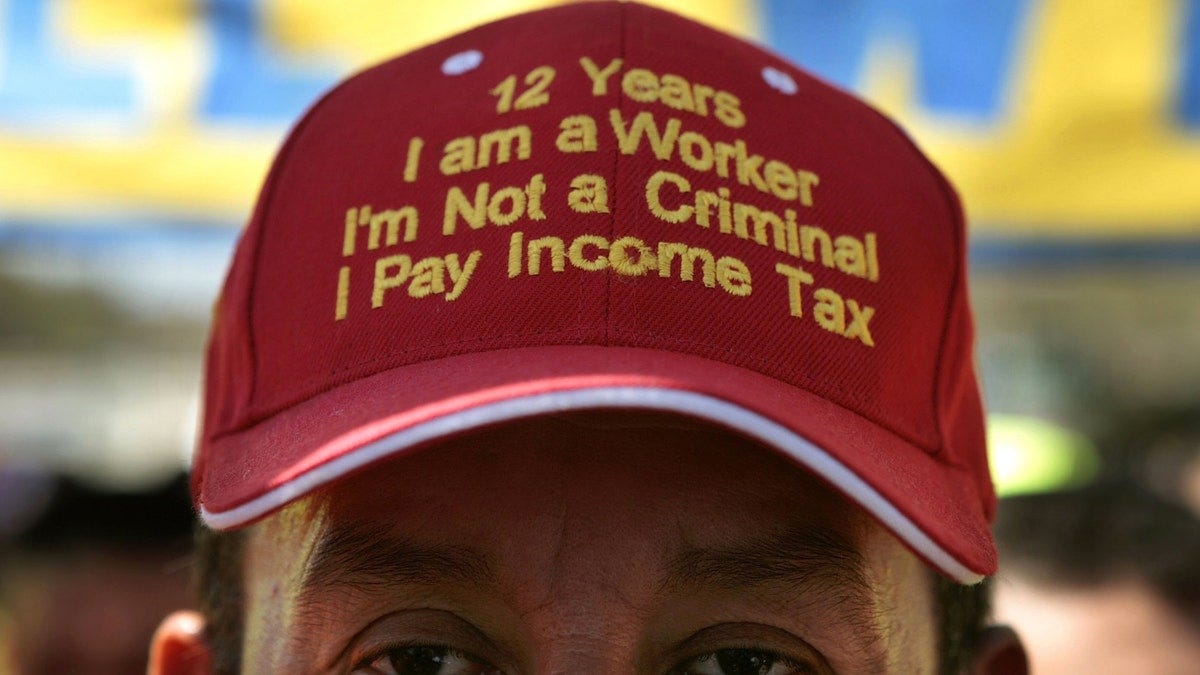

As tax season comes to a close, it's important to remember: undocumented immigrants pay taxes. In fact, we do so despite being excluded from most public assistance and social security programs. We don’t hold much hope of seeing the benefits that our hard-earned money funds.

This year, I filed taxes jointly with my husband. As low-income university students, we both hoped to receive a small refund to relieve financial stress. However, we were taken aback when we realized that due to our financial aid and scholarships we owed money.

How much did we owe?

Federally: $4,153

State: $952

With an open immigration case to fix my immigration status, we simply had no choice; willingly evading taxes can severely harm my ability to file for naturalization. Not being able to work because of this status further exacerbates this financial burden. I have to rely on short term free-lancing work on top of my duties as a student since I’m not able to partake in conventional employment. With so much at stake, I find it frustrating when people doubt our financial commitment to the country. We do our part to contribute to society and receive nothing in return.

So, why do people think we don’t pay taxes?

Myth-busting: Immigrants DO pay taxes

It is difficult to pinpoint the exact origin of the assumption that immigrants don't pay taxes. This myth is rooted in stereotypes about undocumented immigrants draining the economy and not contributing to society. Anti-immigrant groups and politicians have made sure to perpetuate this harmful narrative, intentionally fueling misconceptions about our reality to promote anti-immigrant sentiments. These stereotypes are constantly weaponized against us. Inaccurate and negative portrayals of us in the media and through political discourse make sure to keep the exploitative truth under wraps.

The price we pay is far steeper than just the dollar amount of taxes owed. The Institute on Taxation and Economic Policy reports that undocumented immigrants in the United States pay roughly $11.6 billion in taxes every year. On average, undocumented immigrants pay about 8% of their incomes in taxes. Unseen and unrepresented, we carry the burden as givers in a one-sided relationship. Even when state public assistance programs are open to us, taking part in them is weaponized against us.

The public charge rule is a long-standing policy that allows immigration officials to deny admission or permanent residency to individuals who are determined likely to become dependent on certain government benefits. This policy generates uncertainty and fear for us and makes it difficult for us to utilize the very programs meant to relieve economic struggle even after paying our fair share.

Receipt of non-cash benefits, such as food stamps or Medicaid, can also be considered in the public charge determination if they’re used for a prolonged period or if the benefits are the primary means of support. The implications of this are awful: undocumented immigrants are nearly twice as likely to be food insecure (24 percent compared to 14 percent) and that the median household income of undocumented people is $36,000—almost $20,000 lower than the median income of the U.S. population as a whole.

To make matters worse, we are hunted and harmed by organizations we willingly fund. Our taxes help fund the agencies that terrorize our communities. Domestic Homeland Security and the agencies under it receive majority of their funding from federally paid taxes. Customs and Border Patrol (CBP) and Immigration and Customs Enforcement (ICE) supplement their budgets with fees from immigration services, fines, and violation fees taken at the convenience of our vulnerability.

Unseen and unrepresented, we carry the burden as givers in a one-sided relationship. Even when state public assistance programs are open to us, taking part in them is weaponized against us.

Propina

With conscious efforts to dispel harmful myths and stereotypes, we hope to bring on change so that undocumented immigrants’ contributions can be recognized and reciprocated.

Filing taxes is already a stressful task. Numerous challenges make this process much more stressful and challenging for us, as an undocumented community. This includes limited access to resources, language barriers, and fear tied to engaging with government. This week, we invite our readers learn from and share this guide for those who might need it.

We’ll see you next week!

"We are hunted and harmed by organizations we willingly fund. Our taxes help fund the agencies that terrorize our communities."

Felt this with my entire soul, and often make jokes about it to my partner who is a citizen. The scam that is this American dream our immigrant parents pursued and we now find ourselves grappling with the reality of.